PROFESSIONAL TRADERS

Access cutting-edge trading data and tools that enable professional traders to make informed decisions and compete effectively with hedge funds

“Jorge is an outstanding trend analyst whose innovative and highly valuable work makes him well worth following.”

Access Premium Data

Gain access to the same exclusive data used by hedge funds and quant funds. Unlock critical insights and advanced analytics to elevate your trading performance.

Make Confident Decisions

Trade confidently with data-driven insights and expert analysis. Simplify the complex and make smarter decisions for better results.

Identify Opportunities

Discover opportunities like the pros. Our powerful tools help you spot what hedge funds and quant funds see, so you can act fast and stay ahead.

Navigating the trading landscape can be challenging, especially when faced with an overload of information that often leads to confusion and poor decisions. We understand your concerns and offer a clear path forward.

- Simplify your trading process with an intuitive platform that combines essential data in one place

- Our expert insights break down complex data into actionable strategies

- Trade with confidence, knowing you have the right information at your fingertips

Trend Analysis Based on:

Risk, Liquidity, Positioning, and Technicals

Data Collection

Every day, our systems collect important market data:

- Every Call and Put option traded for all U.S. stocks, to compute Delta Neutral and Gamma Neutral for every stock in the US.

- Every Buy and Sell Transaction executed in Dark Pools, to analyze market positioning for every stock in the US.

- Daily pricing data powers our advanced technical analysis model to help you understand trend direction and strength for every stock in the US.

Hedge funds and quant funds have kept this important data exclusive to maintain their edge. Now, you can access to the same data to enhance your trading strategies.

Data Analysis

- Our systems utilize the Delta Neutral analysis to track and monitor the flow of liquidity into and out of a stock. The Gamma Neutral analysis is utilized to determine whether the stock is in a “risk-on” or “risk-off” mode.

- The market positioning analysis of Dark Pool data helps determine whether hedge funds and quant funds are buying or selling the specific stock.

- Our forward-looking technical analysis model, tested with over 30 years of data, evaluates price velocity and acceleration to rank trend direction and strength, outperforming traditional indicators like RSI and MACD.

Hedge funds and Quant funds guard this valuable analysis, insights that you deserve access to for successful trading.

Signal Generation

Our powerful, state-of-the-art computers analyze the collected data overnight to produce Buy and Sell signals, delivering fresh insights ready before the market opens each day.

Hedge funds and quant funds utilize this computing power to gain an edge, power that is now within your reach to elevate your trading strategies.

GFR provides access to the same proprietary risk, liquidity, and positioning data used by 8 of the top 20 hedge funds in New York managing $160 billion in assets.

Our analysis reveals the true drivers of market trends, emphasizing the importance of monitoring Risk and Positioning.

The GFR Stock Model evaluates a stock’s trend strength by analyzing risk, liquidity, positioning, and technical factors.

Unlike moving averages, which primarily reflect past performance, our approach focuses on anticipating trend changes, delivering forward-looking analysis to enhance trading.

Trying to evaluate the strength of a stock trend without knowing whether large funds are buying or selling in dark pools is like flying a plane at night without radar—you’re navigating blind.

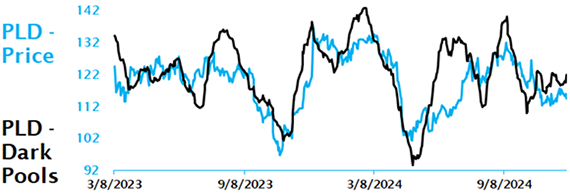

Notice how the price (blue) closely tracks the buying and selling activity in the dark pools (black).

Position analysis using data from Dark Pool activities serves as your radar, revealing whether a trend is likely to continue or reverse. This insight keeps you fully informed about market dynamics, enabling smarter and more confident trading decisions.

Position analysis is your ultimate trading edge.

For years, hedge funds and quant funds have used Dark Pool analysis for a market edge.

Now, thanks to the GFR website, professional traders can access this valuable data too.

Uncertain about stock movements

Depend on charts and news

With Dark Pool Data

(Hedge Funds & Quant Funds)

Access to real-time data

Visibility of actual buyers and sellers

See Dark Pools' influence on trends

Level The Trading Playing Field

Trade Smarter With Exclusive Data

For over 12 years, the top 8 hedge funds in New York, managing $160 billion in assets, have relied on our insights and expertise.

Now, for the first time, you can tap into their success by accessing the same high-quality data and models they depend on.

3 Easy Steps To Making Better Trades In Minutes

Sign Up for Your Free Trial

Access Your Data Dashboard

Start Trading Smarter

Sign Up for Your Free Trial

Access Your Data Dashboard

Start Trading Smarter

Unlock Top Trading Data for Professional Traders

At Geometric & Financial Research LLC, we believe that every trader deserves access to the same high-quality data and analytical tools that top hedge funds use.

Many traders face the frustrating reality of being outmaneuvered by institutional investors who have access to sophisticated data that is often prohibitively expensive.

We provide a solution with our comprehensive data platform, which includes exclusive Dark Pool Data, Delta Neutral, and Gamma Neutral analytics—all for a fraction of what larger firms pay.

By utilizing our services, traders can significantly improve their entry and exit points, leading to smarter trading decisions and increased profitability.

- Make confident trading decisions without the stress

- Gain insights that help you identify profitable opportunities

- Improve your trading strategies with proven analytical tools

- Feel in control of your financial future

- Compete effectively with top hedge funds

- Experience a more relaxed and successful trading journey

- Transform into a skilled trader with reliable information at your fingertips